Retail Pe Partnership

FINANCING CHALLENGES ACROSS THE VALUE CHAIN

Brands

Weak retail reach

due to last-mile gaps

Distributors

Working capital

constraints

MSMEs

Manual KYC, collateral

heavy and complex procedures

Retailers

Limited stocking and sales growth

*As a result, sales velocity slows, distributors face inventory pileups, & brands struggle with retail penetration gaps

India's retail ecosystem-is driven by over 60million small retailers, face severe credit limitations

Despite contributing a massive share of national consumption, this segment remains under-financed.

HOW WE ADDRESS THE INDUSTRY CHALLENGES

Instant

digital onboarding

Zero-history

credit scoring

Quick loan

processes

Improved retail

reach

Reduced capital needs

and faster billings

Increased

stocking capacity

OUR VALUE PROPOSITION

Proprietary True Score algorithm for smarter credit scoring

Easy plug-and-play integrations with partner brands like:

Unique repayment model tied to business cash flows

Enhanced market penetration for partners brands like

Secured Retail shop loans and MF-backed secured lending

STRONG EARLY TRACTION

65K+

Customers, merchants and retailers onboarded

PROCESS FLOW

Key technology partners

OUR PHILOSOPHY

“Innovation must serve the common entrepreneur. If technology doesn't simplify life for a small retailer, it's not complete." -

Kousik Chatterjee

India's retail ecosystem-is driven by over 60million small retailers, face severe credit limitations

Despite contributing a massive share of national consumption, this segment remains under-financed.

THE OUTCOME

12-15% sales uplift through increased retailer throughput

Improved distribution efficiency without additional credit burden

Strengthened ecosystem collaboration between brand, distributors, and retailers

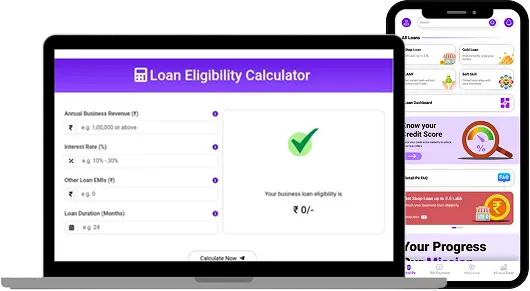

Smart Dashboard: Track limits, repayments, and offers

WHY PARTNER WITH US

Proven model resolving long-standing margin conflicts distribution

Margin uplift & better unit economics across the chain

Technology-ready APIs enable fast integration

Scalable across categories of brands (Telecom, FMCG, Farma etc.)

Revenue Sharing

LET'S CO-CREATE A DISTRIBUTION

GROWTH ENGINE

Explore pilot with your distributor network

Joint roll-out via API integration

Unlock higher sales velocity & deeper market penetration

*As a result, sales velocity slows, distributors face inventory pileups, & brands struggle with retail penetration gaps