Retail Pe Partnership

FINANCING CHALLENGES ACROSS THE VALUE CHAIN

Banks

Weak retail reach

due to last-mile gaps

Distributors

Working capital

constraints

MSMEs

Manual KYC, collateral

heavy and complex procedures

Retailers

Limited stocking and sales growth

*As a result, sales velocity slows, distributors face inventory pileups, & banks struggle with retail penetration gaps

India's retail ecosystem-is driven by over 60million small retailers, face severe credit limitations

Despite contributing a massive share of national consumption, this segment remains under-financed.

HOW WE ADDRESS THE INDUSTRY CHALLENGES

Instant

digital onboarding

Unique

credit scoring

Quick loan

processes

Improved retail

reach

Reduced capital needs

and faster billings

Increased

stocking capacity

OUR VALUE PROPOSITION

Proprietary True Score algorithm for smarter credit scoring

Easy plug-and-play integrations with partner banks like:

Unique repayment model tied to business cash flows

Enhanced market penetration for partners banks like

Secured Retail shop loans and MF-backed secured lending

STRONG EARLY TRACTION

65K+

Customers, merchants and retailers onboarded

PROCESS FLOW

Key technology partners

OUR PHILOSOPHY

“Innovation must serve the common entrepreneur. If technology doesn't simplify life for a small retailer, it's not complete." -

Kousik Chatterjee

India's retail ecosystem-is driven by over 60million small retailers, face severe credit limitations

Despite contributing a massive share of national consumption, this segment remains under-financed.

THE OUTCOME

10-12% sales uplift through increased retailer throughput and higher margin impact up to 3%

Improved distribution efficiency without additional credit burden

Strengthened ecosystem collaboration between banks, distributors, and retailers

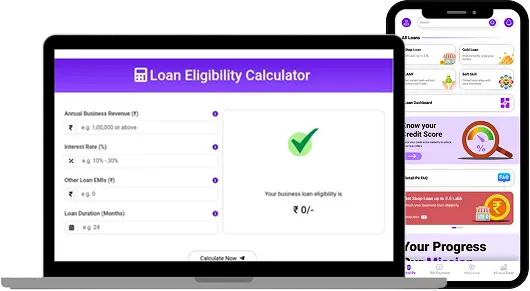

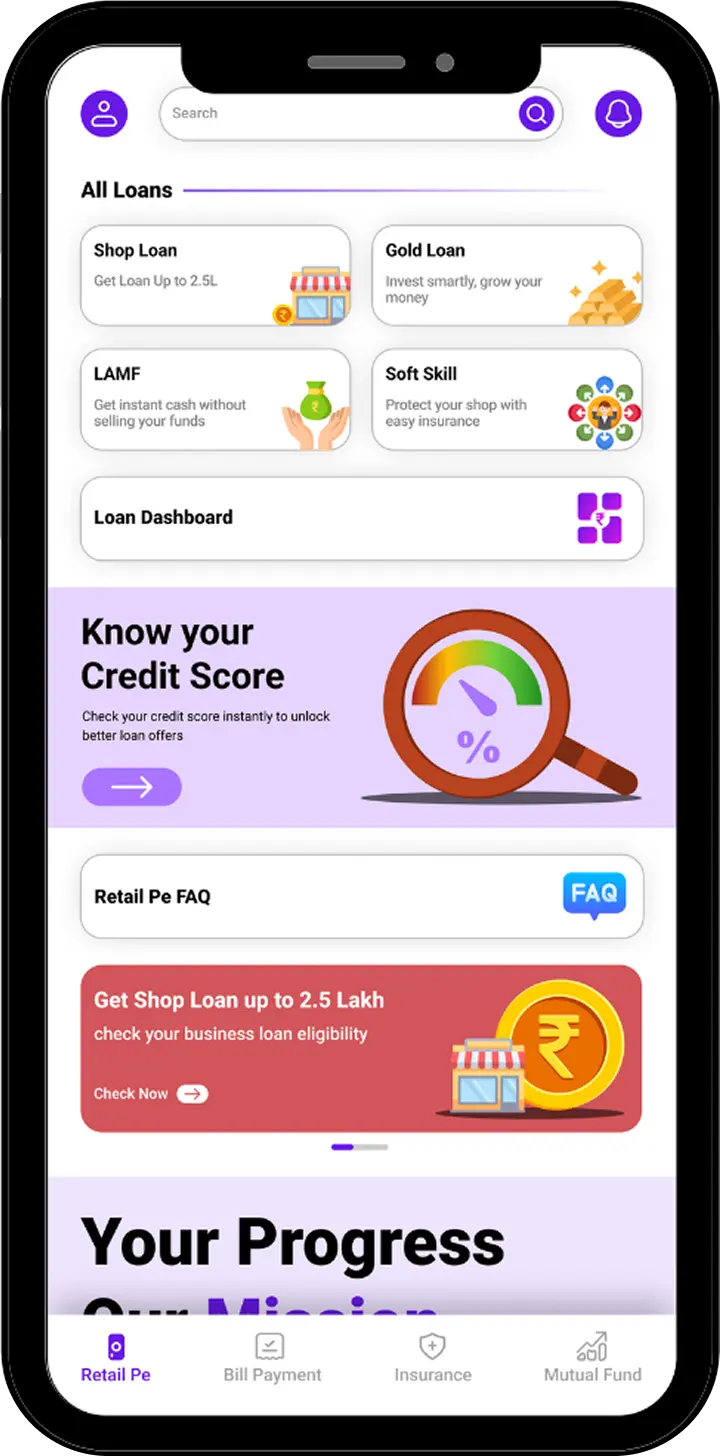

Smart Dashboard: Track limits, repayments, and offers

First of a kind unique collection model

WHY PARTNER WITH US

Proven model resolving long-standing margin conflicts distribution

Technology-ready APIs enable fast integration

Scalable across categories of branches (telecom, retail, digital, etc.)

Higher Revenue Sharing

Proposed Co-Lending Products

Retail Shop/MSME Loan: ₹50,000-₹5 lakh

LAMF (Loan Against Mutual Funds): Real-time lien marking

Gold Loan: Secure phygital operations & vault partners

Soft Skill/Vocational Loan: High-velocity, short-tenure education soft skill financing to cate company employees

Value Addition for Banks

Expanded MSME outreach

Low-cost, tech-enabled sourcing & monitoring

High-quality secured portfolio

Scale-up potential across 50M+ retailers

*As a result, sales velocity slows, distributors face inventory pileups, & banks struggle with retail penetration gaps